How to fail IEO?

Do you want to launch the crypto IEO but don’t know what to start from and how not to fail IEO. In this article, we will go from the opposite and provide the most terrible tips on failing IEO. Let’s go through all the stages of preparing to IEO briefly and define the weakest places where an owner of the crypto project can stumble. Moreover, you will find out how to avoid the most popular mistakes made by crypto startups and the answer to the question—what is a crypto launchpad? Here we go!

What is an IEO in crypto?

Let’s start our trip with the IEO crypto meaning explanation. An initial exchange offering (IEO) is fundraising for the crypto project arranged by an exchange. An ancestor of the IEO is ICO (Initial Coin Offering). So, what is the difference between ICO and IEO?

Generally speaking, the main difference is that ICOs are arranged by the crypto projects independently, while IEOs are launched by crypto exchanges providing crypto projects with additional pre-IEO and post-IEO marketing and liquidity services. Therefore, crypto projects choose to launch initial exchange offerings to build an extended community and involve new investors. To learn more about how IEO differs from ICO, read this article.

Source: Ifpnews

Insufficient analysis and market scenario

Before knocking at any crypto exchange to launch your IEO, you first need to analyze the success of your project and the market scenario. Non-understanding of the market needs will help your currency pass by your target audience and miss the gap in the market. If you really want to launch the failed IEO, come up with an idea similar to million ideas created in the crypto world and non-implemented in reality after fundraising. This will help cut your crypto project entirely.

What about marketing? Marketing plays a sufficient role in launching IEO. How are you going to promote your token and involve new investors? Launching a new crypto project doesn’t guarantee success in the crypto market. After all, your main purpose is to make investors place their capital in buying your token. Therefore, you can choose a crypto exchange offering a crypto launchpad service to help involve new investors in your project.

Fail of a minimum viable product (MVP) development

A naked idea without a strict plan for its realization won’t ensure your project is interesting to somebody except for you and your team. While offering your potential investors a naked idea, you risk being attributed to the number of scammers.

After applying for the crypto exchange to list your crypto project, an exchange will consider whether your team has progressed in the implementation of your idea or not. When launching IEO on the crypto exchange without a minimum viable product (MVP), you will fail your IEO. The development of MVP is necessary for launching IEO on reputable crypto exchanges.

Source: Clevertap

For instance, let’s consider the crypto wallet provider Bread (BRD). Before launching their IEO, they had already designed a functional app with multiple users.

Drafting a non-representative white-paper

If you want to fail IEO, draft a bad-written white paper. This will become one more step to the total failure of your IEO. A white paper will help investors understand your project’s idea, tokenomics, and roadmap and investigate the team members’ previous experience. A well-designed white paper is the face of your further crypto project. So, while trying to fail your IEO, don’t forget to show your dirty un-washed face without make-up to your potential investors.

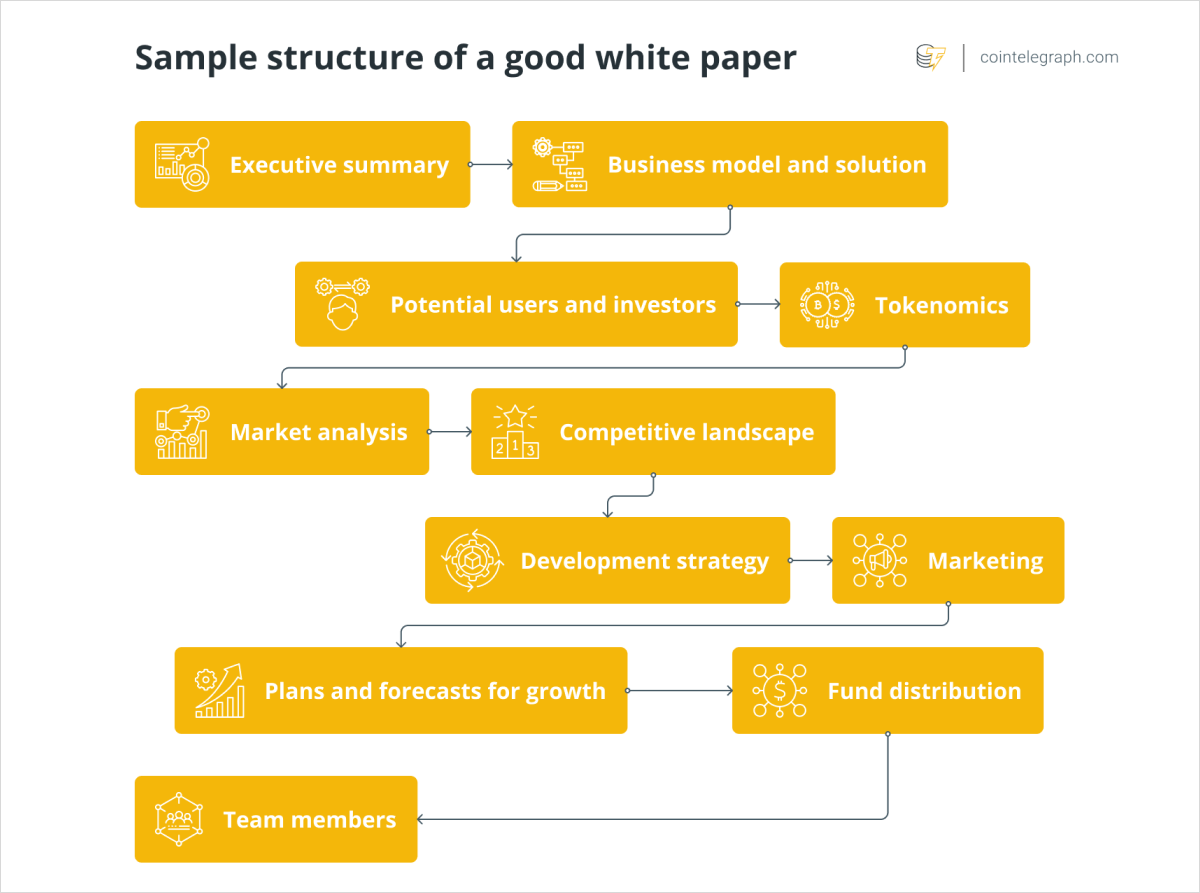

Source: Cointelegraph

A white paper plays the role of a selling proposal or pitch. Therefore it should be comprehensive, and factual and highlight all the benefits of the crypto project. In other words, a white paper is a well-documented account of everything your investors should know about the project. So if you want to fail your IEO, here you will find out several anti-tips on what you need to do:

- Don’t split your white paper into small brief chapters, but write it like a solid canvas. Don’t write a short, understandable informative white paper that will catch potential investors and stimulate them to read it to the end.

- Mute how potential investors can benefit from the project. The main goal of any white paper is to highlight the benefits they can get while investing in this crypto project. Therefore, to fail IEO, just pour water and mute the benefits and profits investors can get from this crypto project.

- Hide problems and gaps that your project tries to solve. The worst crypto project is that it doesn’t have practical use. Without shedding some light on the problems your crypto project will solve, you won’t be able to attract potential investors to buy a token. In addition, highlighting problems is crucial when applying for the launch of IEO on reputable crypto exchanges. If a crypto exchange sees real problems your crypto project will solve, they launch your IEO faster. While presenting the importance of your project, you can support it with flowcharts and diagrams. Some good tools used for diagrams and technical architecture are OmniGraffle and Lucidchart.

- Don’t establish your team’s experience and credibility. If you want to arouse the suspicion of your potential investors, hide the previous experience of your team members. The lack of information about the previous experience of your team members will cause distrust of the potential investors and lead to an undoubted failure.

Second-rate marketing

As mentioned above, a well-designed marketing strategy helps you involve new investors in your crypto project as much as possible. Without a well-designed marketing strategy, an IEO will raise several hundred USDT since cryptocurrency exchanges list around 20 crypto projects monthly. Marketing is fuel pushing up your project ahead. Therefore, without marketing, your project will be just one more non-interesting unremarkable project that won’t catch your potential investors’ attention.

Developing an ineffective IEO marketing campaign

To catch your potential investors’ attention, you must use marketing activities with influencers, push up your project on reputable platforms, arrange АMA (Ask Me Anything) sessions, and much more.

Without a well-thought marketing campaign, the crypto project’s lifespan will drastically decrease. As a result, the project won’t catch investors’ attention and won’t lead to financing. The main purpose of the top-notch marketing strategy is to attract the appropriate project audience and create buzz-worthy hype around the product while involving big investors. Instead of wrestling with how to design an effective marketing strategy for your crypto project, apply for a crypto launchpad with an in-built pre-listing promotion campaign.

Building a narrow community

Do you want to fail your IEO? Then don’t care about building a vast community around your crypto project.

To fail your IEO, don’t care about growing a user base around the project on general social channels, including Telegram, Facebook, Instagram, Reddit threads, Youtube, and much more.

In addition, decentralized social networks have demonstrated highly-convertible users. Without striving to extend the potential target audience, you can forget about niche platforms where all the crypto startups promote their projects, including Uptrennd, Minds, Steemit, Bitcointalk, and Cryptocurrencytalk. These social networks and media forums are the best platforms to involve new investors looking for promising crypto projects.

Hiding information about crypto project’s founders in social networks

If you want to cause suspicion among potential investors, just hide information about the crypto project’s founders in social networks. All investors are interested in the previous experience of the team. The intention to purchase a token depends on the involvement of the team’s members in previous successful projects.

A strong team with competent knowledge of IEO and blockchain environment provide the crypto project with success in the future. Since the investors choose the projects supported by the teams with a great background in the blockchain field, don’t hide the information about your team’s members in the social networks.

If a potential investor doesn’t find enough information on the website, white paper, or social networks, they won’t believe this project isn’t a scam.

If you want to scare away potential investors, just build a team with members with bad reputations in the crypto field or invite scammers to your project.

Set overestimated KPI (Key performance indicators) for your project

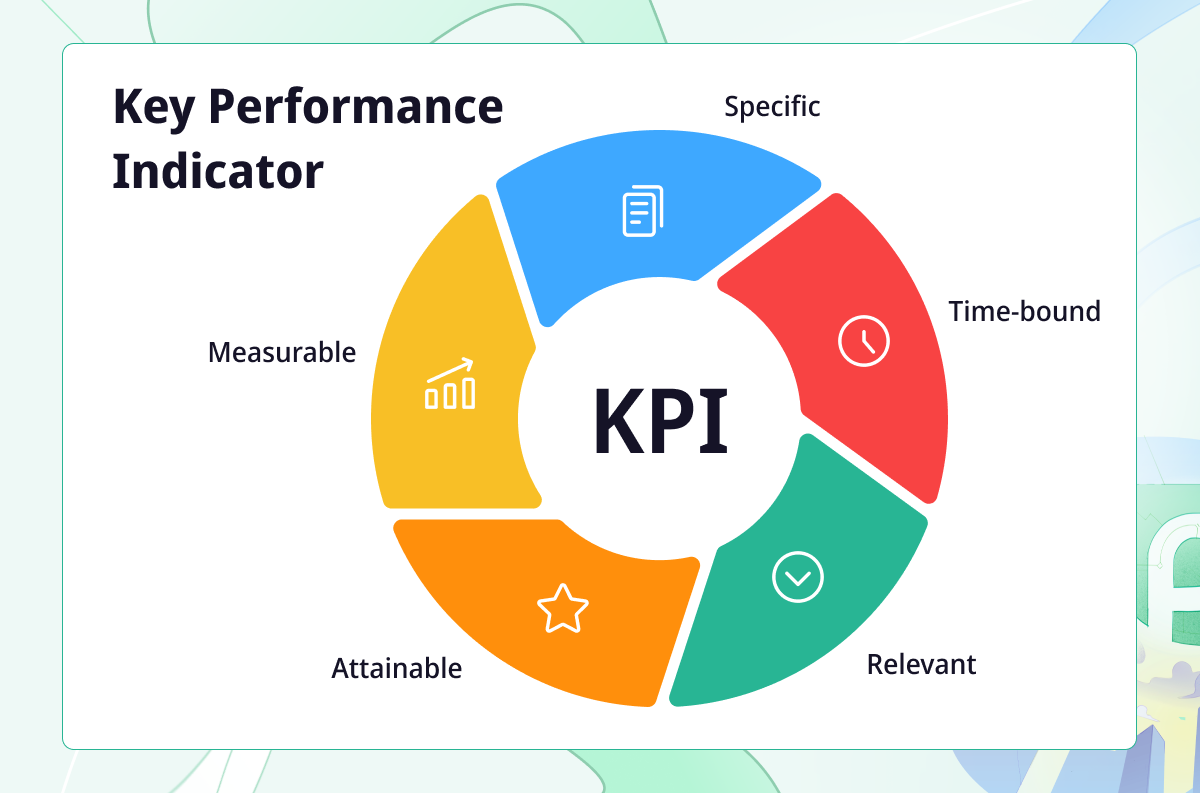

The most widespread mistake of the young crypto projects is that they set overestimated KPIs and wait for overvalued results. Nowadays, only 2 percent of fundraising projects reach high amounts. If your project allocated around 25000 USDT in marketing, you can count on profit х2 from it.

Key Performance Indicator

Promise high profits to your potential investors

If you overvalue the price of IEO and promise your target audience that they can increase their profit 3 or 4 times, you will attract traders who buy tokens to throw them up on the market after the finish of IEO. This will cause inflation and a drop in the token’s price. On the other hand, you must spend almost all the profit to support your project’s liquidity. Otherwise, your project can turn into a scam.

Avoiding professional PR and promotion support for your token

If you want to fail the IEO, avoid professional PR and promotion support for your token or coin. Very often, young crypto teams think they can succeed and hit the jackpot without professional support or services.

Newcomers think that they, with their naked idea, will conquer the peak of the crypto world immediately and choose top exchanges for their IEO, including Binance. However, they don’t even imagine what they will do if traders don’t show interest in their coin.

This is the most popular misconception among newcomers in the crypto field. To reach success in launching IEO and further listing a token, you should apply for Crypto Launchpad on P2B.

What is a launchpad crypto on P2B?

This service offered the P2B Exchange, includes:

- Preparation and promotion;

- IEO Launchpad fundraising;

- Designing a pre-listing campaign;

- Token listing on exchange;

- Expansion on other crypto markets;

- Market-making and liquidity services.

The preparation and promotion stage includes:

- External IEO crypto community promotion;

- Extending a crypto community;

- Custom Email campaign to verified P2B users;

- Internal P2B promo;

- AMA sessions.

For crypto projects, IEO with the P2B exchange is an easy and reliable way of rolling out the crypto launchpad without wasting much money, time, and effort on promotion and marketing.

The P2B exchange offers its customers full-cycle support of the crypto project, starting from crypto project marketing and ending with post-listing promotion, market-making, and liquidity services. Market-making and liquidity building is a crucial but often overlooked step. After a new token listing, you can market your project further to reach more investors and gain further traction.

The P2B team manages the crypto project from scratch, from the token promotion to the token listing services and executing an effective marketing strategy after listing the token.

If a crypto startup launches IEO, it gets more chances to attract new investors. Therefore, the listing token process will be more successful and get more results. IEO is just the first step in the involvement of investors in the crypto project.

Due to the interaction with a pool of reliable companies in the crypto projects’ promotion and advanced liquidity services, including PromoJ and LiquidLines, the P2B exchange helps crypto projects involve impactful investors in the project and provide the crypto project with high-level liquidity of a new listing token.