Why customers can’t get their tokens immediately during IEO/IDO

Are you interested in how IEO and IDO work and why investors can’t get their tokens immediately after purchasing them? In this article, you will find out why investors can get their tokens only after finishing the IEO/IDO. Let’s consider this particularity of IEO/IDO in detail.

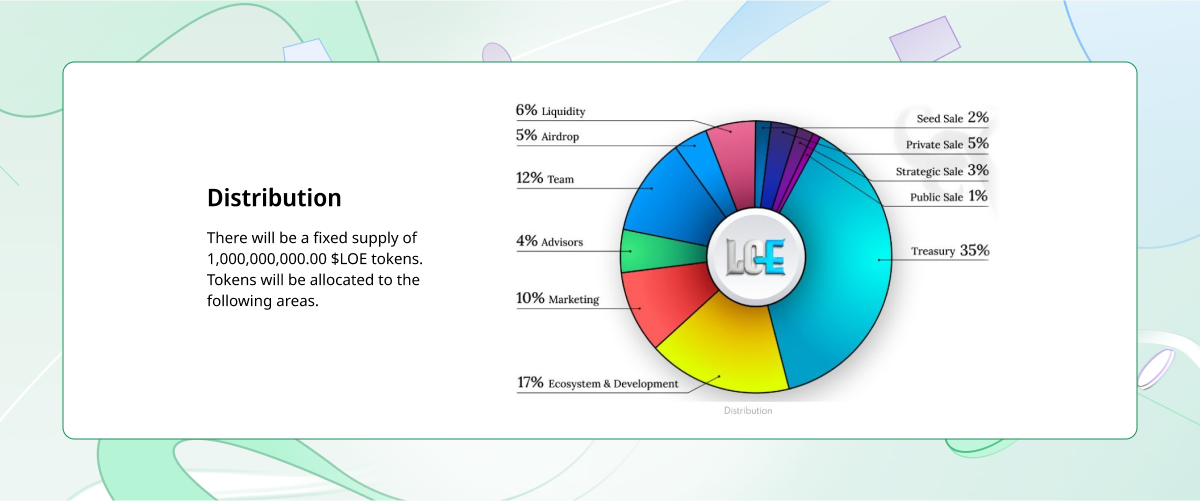

Source: Legends of Elysium whitepaper

Source: Legends of Elysium whitepaper

Main tokens sales rounds

Let’s start our crypto trip in the exciting IEO/IDO world by considering the main stages of token sales. There are several main stages of token sales when a new crypto project enters the crypto market:

- Seed sale – token sale to the scale investors, including venture funds and large private investors;

- Private sale is the second stage of token sales to small investors, influencers, and people who provide the crypto project with marketing services.

- Public sale includes ICO, IEO, and IDO. At this stage, anybody can participate in token sales. It all depends on the possibilities offered by the platforms that launch IEO or IDO.

At each stage of the token sales, an investor gets their tokens at the discussed selling rate, pointed out in the tokenomics of the sales stage. Each stage has its participants, selling rate, limits, and vesting phases. This is a key answer to the main question asked in this article—why can’t investors get their tokens immediately?

When all the tokens are bought and brought to the investors, this can cause mass token sales at the crypto exchanges, including centralized and decentralized exchanges.

The token listing goes with a significantly higher price than at all the previous stages. When the listing comes, investors usually have a great profit from the previous stages, including seed and private sales, and pay attention to this. Therefore, they start selling all their tokens to get a profit. As a result, the token price significantly drops. To prevent this event, crypto enthusiasts have implemented vesting in the tokenomics of the crypto projects.

What is vesting?

So, let’s consider what vesting is and how it’s used in IEO/IDO. Vesting is a mechanism of blocking and holding purchased tokens in the determined period. The blocking term is a vesting period.

Thus, a crypto project freezes a part of the tokens received by investors to hinder the entire selling of all the tokens and the price rate dropping. Moreover, the vesting term also acts for all the tokens obtained by the crypto project owners and developers. However, terms can differ; they are usually more strict for the project owners and developers than for investors. You can find these terms in the blockchain smart contracts; anybody can’t bend these terms. In addition, sometimes, you can find the vesting term’s conditions in the crypto project’s whitepaper.

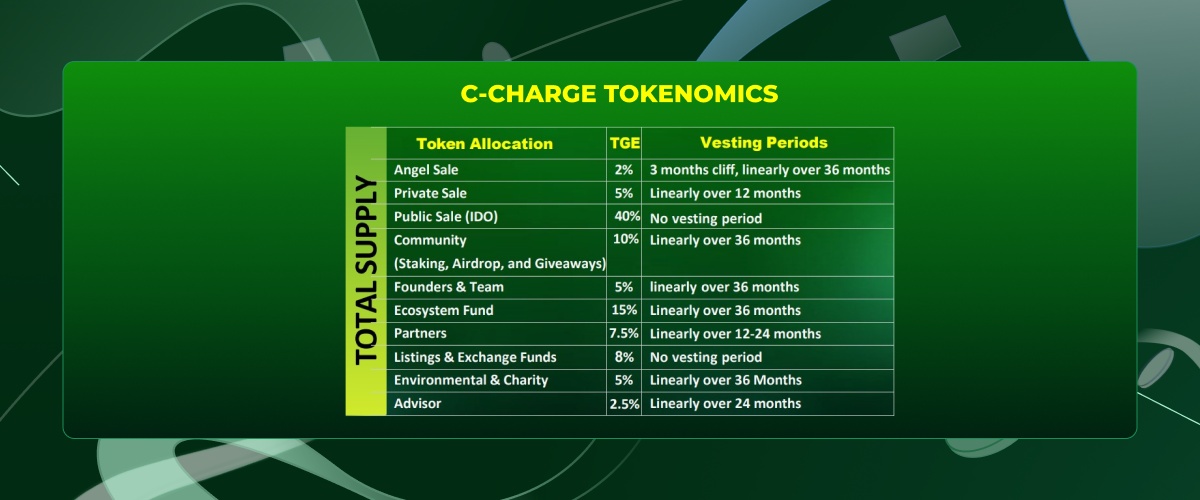

C+Charge (CCHG) tokenomics

You can see the crypto project tokenomics illustration of the C+Charge (CCHG) crypto project, where the vesting rules and terms are pointed out. C+Charge (CCHG) belongs to the top newly launched crypto project and is a new-age payments app enabling mass adoption of carbon credits by rewarding EV owners for charging their vehicles. Let’s consider their tokenomics model in detail.

Source: C+Charge whitepaper

There are several tokenomics concepts, including “cliff,” “token allocation,” “TGE,” and “vesting periods,” which we will explain.

Cliff is a token-blocking term after TGE before the start of vesting. This term is pointed out in months.

TGE (Token Generation Event) is tokens distribution to the first owners (investors and funds) and listing tokens on the exchange.

% on TGE is a percentage of tokens that you can get and sell in the listing term.

Allocation is the number of tokens from the common supply available for this sales phase.

Vesting is a common vesting term.

Source: C+Charge whitepaper

Let’s consider Angel Sale and conditions for this stage:

- Category – Angel sale;

- Allocation – 2 percent;

- Cliff – 3 months;

- Vesting (monthly) – linearly over 36 months;

- TGE – 2 percent.

Explanation

For the Angel Sale category, 2 percent of tokens are available. The total supply is 1 billion. Therefore the number of tokens allocated for the Angel sale stage is 20 million. They are distributed among investors at the Angel Sale stage. Cliff is 3 months. Since the TGE moment, after getting 2 percent of 20 million available at the TGE stage, the rest tokens will be frozen for 3 months. During the TGE, investors get 2 percent or 400 000 tokens. Then investors will be getting their tokens in equal parts for 36 months. This is an example of the line vesting type.

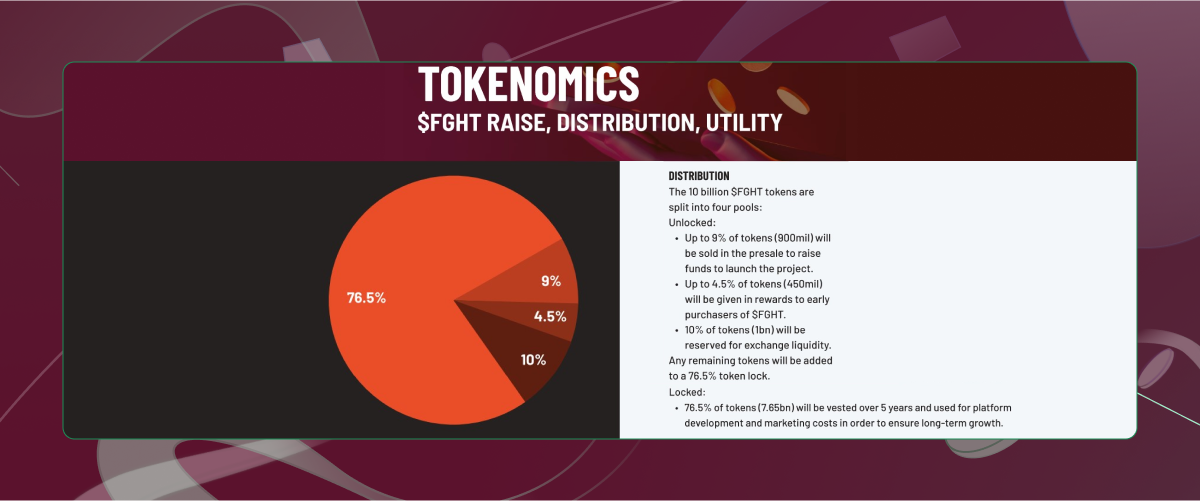

Fight Out tokenomics

Let’s consider another example of token distribution – The fight Out project. Fight Out is one of the most popular crypto projects today that has a mission to revolutionize the move-to-earn space. It has designed a fitness app. In the future, the crypto startup is going to build real-world gyms. In the whitepaper, we can view their tokenomics model.

Source: Fight Out whitepaper

Let’s consider it in detail:

A general number of $FGHT tokens are split into four pools. There are three unlocked pools:

- Up to 9 percent tokens will be sold in the presale to raise funds to launch the crypto project.

- Up to 4.5 percent of tokens will be given in rewards to early purchasers of $FGHT.

- 10% of tokens will be reserved for exchange liquidity.

A locked pool contains 76.5 percent. These tokens are vested for 5 years and used by the platform development and marketing costs to ensure long-term growth.

Vesting types

Let’s consider the main vesting types:

Line vesting is tokens distribution in equal parts in the settled time period. If a vesting way isn’t pointed out in the whitelist, a line vesting model is used for this token. An example is described above.

Twisted vesting is tokens distribution in the random portions in the pointed-out period term. This vesting type is less common than line vesting but also is used by crypto projects.

As usual, the TGE doesn’t exceed 25 percent and is often 10 percent. The lower this rate is, the more chances the crypto project is interested in its development. Similar to the vesting term, the longer it is, the more chances are that the crypto project has a long-term development plan. A usual vesting term takes from 4 months to 2 years.

Summary

The vesting term and tokens number allocated for vesting are different in different crypto projects. However, the longer a vesting term is, the more chances the crypto project will implement ideas announced in the whitepaper. The vesting term is used to prevent throwing up tokens by investors during the listing and the price dropping. In addition, there are several vesting types used by crypto projects, including line vesting and twisted vesting models. A line vesting model is more popular than a twisted vesting model. All the vesting conditions are in the smart contacts. Sometimes, crypto projects showcase the vesting conditions in their whitepapers. As usual, a vesting term takes from 4 months to 2 years.