What is the Crypto Fear and Greed Index?

Intro

Trading is always conjoined with risks and other different stimuli that might make market participants emotional. Emotions are basically the drive of every market, including the crypto market. Two feelings, in particular, govern the market behavior: fear and greed.

Fear of missing out is also a powerful drive ‒ it makes people decide whether to buy certain crypto or not. But the panic of the price rising is the one thing that contradicts the fear of missing out.

So, yes, emotions and feelings heavily influence any kind of economics, especially the crypto market where new coins launch is not under any government’s control. The good news is that these things can be somewhat measured to get at least some prediction about market directions. The Crypto fear and greed index is the value that determines the whole mood of the crypto market.

Learn your basics: fear and greed index

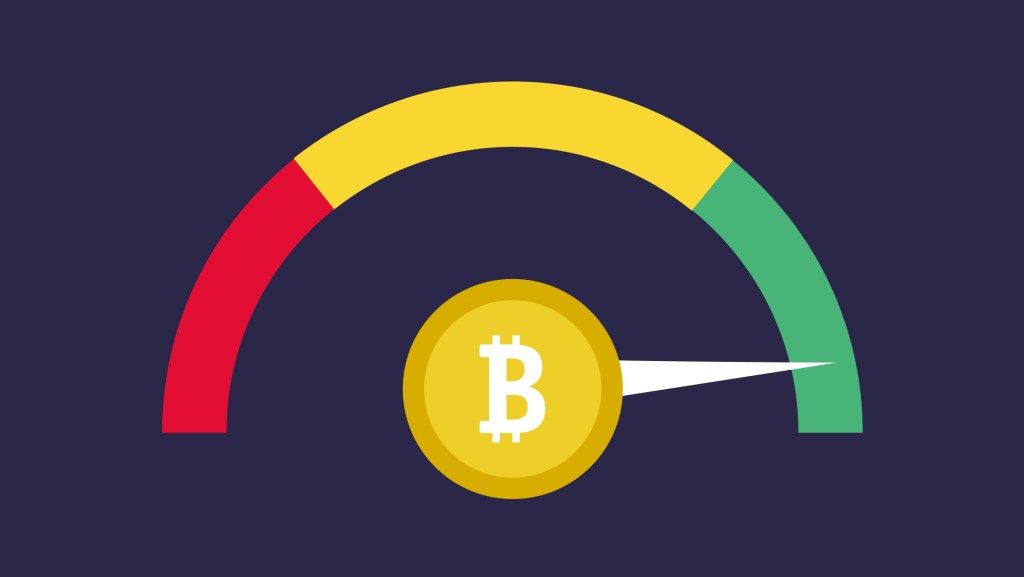

This index is used to analyze the investors’ behavior to determine the risks and predict some price fluctuations. It represents the balance between the fear of missing out among the investors and the greed they experience when the crypto market situation pressures them into selling crypto assets. This balance is really important in terms of predicting the future directions of the crypto market, but to make your own investment decisions, you need a little bit more than that.

The fear and greed index works roughly like that:

- A certain event happens in the market: some news about Bitcoin emerges, or some country implies a new crypto regulation law. The event can have positive or negative connotations, but nevertheless, the investors make decisions almost immediately ‒ unlike with the traditional stock market where you have to wait until the market opens.

- Considering the news supply about Bitcoin and other crypto coins and projects is constant and the crypto market never closes, it’s easy to imagine that crypto investors have more erratic behavior, panic selling Bitcoin or other crypto coins, or otherwise ‒ buying them of the fear of missing out.

- These constant fluctuations in investors’ behavior eventually shape the crypto fear and greed index.

You, as an investor, can use the fear and greed index crypto to make your own investment decisions and adjust your investment plans according to the analyzed data.

The value of the fear and greed index ranges from zero to a hundred. Think of it as the balance scale where zero is a complete fear when investors are pressured into selling their crypto assets like Bitcoin and some altcoins, and a hundred is complete greed where investors are desperate to buy Bitcoin or other crypto coins or tokens due to their fear of missing out.

All the data for the analysis is gathered from various crypto statistics websites that represent crypto investors’ tendencies. But apart from that, a few other sources are being used in order to get even more insight into the investors’ interest in Bitcoin or other certain crypto coins.

What is this index made of?

To make a digital value, you need something that can be counted. Emotions can’t be properly counted, so to measure the fear and greed index, analytics platforms use a few parameters:

- Bitcoin price fluctuations. Since Bitcoin is the most important coin on the market, its fluctuations heavily influence crypto investors’ moods. The main market mood depends on Bitcoin, so other criteria arise from here.

- Volatility of the crypto market. This parameter is measured from the comparison of the maximum decrease in Bitcoin price to the 1-month and 3-month average volatility. Bitcoin is taken into consideration because it represents the directions for most of the market. If volatility gets higher, it’s a sign of the growing enthusiasm.

- The comparison of the market momentum and trading volume. To gather this data, we need to compare representative 1-month and 3-month moving averages when the buying is stronger. This basically indicates the greed of investors.

- Social media also take part in the index! The number of hashtags used for each crypto coin or token and the response rate is taken into consideration to calculate particular coins’ popularity. Surveys are another factor that adds up to the index complementary to social media presence.

- Another important, influential factor is the comparison of Bitcoin to altcoin market capitalization. When Bitcoin grows, the fear of missing out mood rises. Altcoin, on the other hand, generates more speculations, and the market cap for these coins can be growing due to the growing real interest and not just due to speculations, so this one can be considered debatable.

- Overall trends. If the number of Google search queries connected to Bitcoin grows, this indicates a growth in the interest in the crypto market. And as we already know, Bitcoin represents most crypto market fluctuations.

With that in mind, the fear to greed index in crypto is based on the investors’ activity on different platforms ‒ from social media to the exchanges.

Can you trust it for your crypto investing decisions?

The crypto fear and greed index is a really useful analytics tool that allows us to understand the insights of the crypto market from a more or less pragmatic point of view rather than an emotional one. Sure, you can’t measure emotions, but at least we can predict what they represent in terms of crypto-economics.

We on P2B advise you to take this analytics data just like other ones ‒ with a grain of salt and trust your trading experience. Just like any analytics data, the fear and greed index exists only to point directions and not to dictate decisions ‒ buy Bitcoin and other crypto-assets trusting both your crypto trading experience and statistics data.