How to Deliver Your Crypto Coin to Traders and Investors

Intro

Bitcoin was launched in 2009. It was a breakthrough, but very few people seemed to be interested for the first couple of years. It remained under control of a bunch of enthusiasts until the first crypto exchanges were launched. People did not understand all the possibilities that could be offered by digital money yet, but they got an opportunity to easily buy and sell it, which provoked a stunning success in 2012.

Since then, listing on a crypto exchange has become the first step for every crypto coin project that aims to get to the big market. You can lay this out to an outsourcing listing agency, or try to do it yourself. Either way, understanding of the process can help save a lot of time and money.

Two types of crypto exchanges

Crypto exchange is a platform for trading cryptocurrencies. There are two types of them: decentralized exchanges (DEX) and centralized ones. Both have the same goal of being an intermediate between people who want to buy and sell digital coins.

DEX is a network of nodes. Each of them stores all information about transactions. Obviously, the information is encrypted. DEXes usually work automatically and do not have any management teams. They are typically controlled by their communities and developed by independent enthusiasts.

On the contrary, centralized exchanges have management, deliver security, provide support and guarantees, and are usually more advanced in terms of technical implementation. All this makes them commercially attractive for modern traders and investors.

Why do coins need crypto exchanges?

People rarely buy coins and tokens directly, mostly because it is almost impossible to find a reliable partner, unless you know someone personally. Transactions with cryptocurrencies are untraceable and often anonymous. In addition, most countries do not consider this an official payment method and do not regulate it yet. Hence, if you make a deal with a fraudster, no one will help you get the money back.

As opposed to that, exchanges provide security. People do not hesitate to buy digital coins there, because currently it is the only safe way to do it. This is especially relevant in light of the fact that the current crypto industry is still vulnerable to fraud.

What is listing?

Listing of a cryptocurrency is the process of a coin becoming available for trading on an exchange. If a coin is listed on at least one exchange, it means everyone can buy it. This is actually the point of majority of the projects. They want to sell as many coins as possible and earn as much as they can.

However, it does not justify hurrying. The project team should be wise making decisions about listing. It is an important milestone in the project’s lifecycle, so every step has to be thoroughly analyzed.

Typical process of getting your coin listed

Every exchange has its own conditions and requirements for listing. However, it is useful to know the main logic of the process, which can be roughly divided into 5 steps.

1. Preparations

The very first step is self-assessment and preparations. Your new coin has to be innovative. It has to solve an existing problem or improve a current solution. Of course, investors understand that developing a high quality product is impossible without funds, but you need to prepare marketing materials to convince them that your project is worth investing in.

You should also prepare all the materials that will be required by the exchange. They may vary depending on the exchange, but you can learn about the essentials from our own coin listing process.

2. Finding Your Exchange

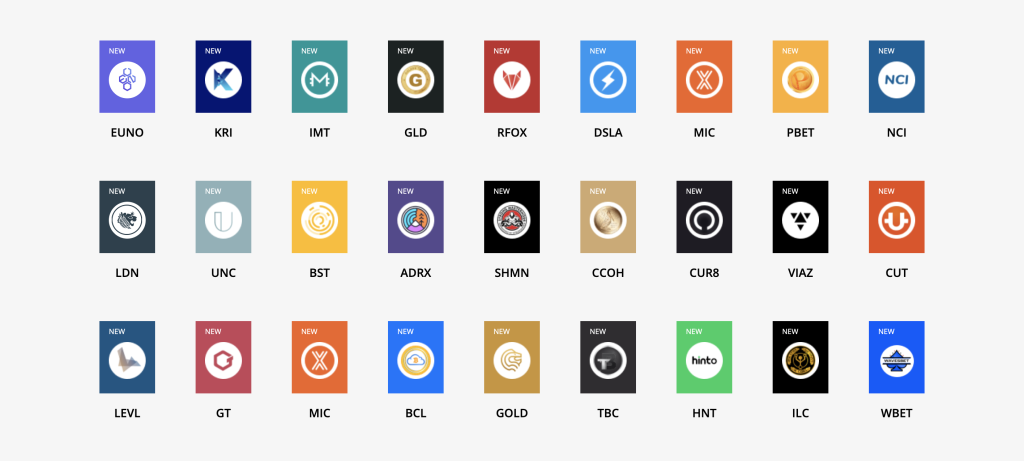

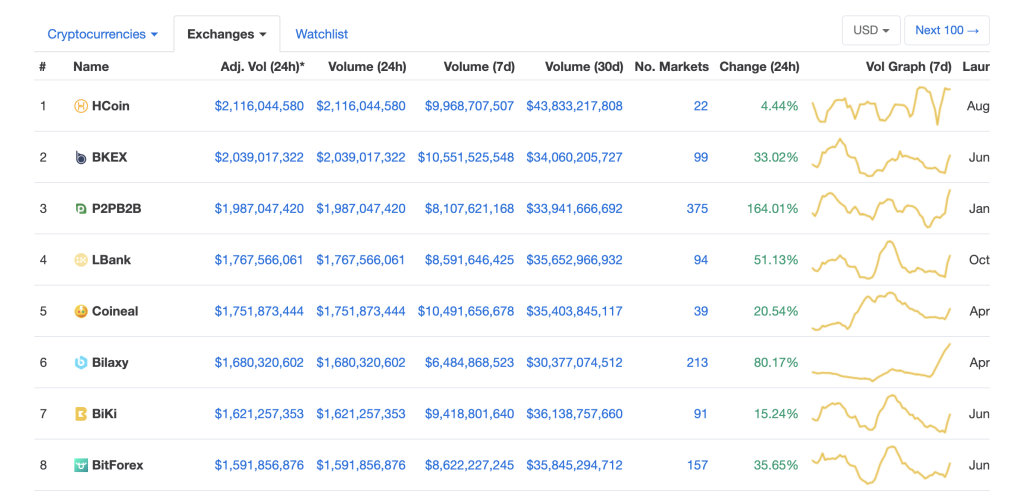

The next step is to find the right place to publish your coin. You should pick your first exchange wisely. It must be well-balanced in terms of pricing, user base and trade volumes, and the fullness of services provided with listing. You may as well start your research with exchanges that have high rankings on CoinMarketCap‘s dynamically updated list of top exchanges by trade volume.

The common rule declares that a project should aim to be published on as many platforms as possible. Proper exposure makes a coin better known. However, you should not haste with this. It is better to analyze different options and choose the most reliable and cost-effective ones.

3. Negotiations & Agreement

Decentralized exchanges are the easiest to list on. Usually, the process is conducted automatically for a small fee. The coin obviously needs to fulfill simple technical requirements, and after that, it becomes available for trading. Nobody really cares about what is the technology based on. If the system implements transactions, the coin can get listed.

However, it is centralized exchanges that are of real interest — essentially because they are more stable and reliable for traders. Once you have several exchanges to choose from, you should study their listing offers and pick one that offers the most for an affordable price.

Good service packages typically include market making to stabilize the price and generate initial trade volumes for your coin; IEO launchpad, if necessary; and proper announcements for the entire exchange community, both via email and social media.

4. Deployment

Once you complete the negotiations and sign the agreement with the exchange you have selected, your coin will be tested and deployed.

This will not take long. Outside the most technically complicated cases, the whole process may take up to a week, so consider that in your scheduling. After listing, your coin finally becomes available for public trading, and corresponding announcements are made for the communities of the exchange and your project.

5. Post-Listing Activities

To get listed is just the first goal to be achieved. Another important goal is to remain listed and relevant, and this is harder than it looks. You need to generate first trade volumes with market making and gradually proceed to natural trading. You need an advertising campaign to generate demand. You need to show your project’s progress under active development. This is the only way to take wind and increase the liquidity of your coin.

Such are the basics about listing on a crypto exchange. It is useful to note that all decisions should be based on the features and objectives of a particular project. Please feel free to contact us with any further questions!