Hard Forks vs Soft Forks within Сryptocurrencies

One of the most exciting features of cryptocurrencies is that they are built on open-source code. This means that anyone can look at the code, for example, Bitcoin, and no one is keeping it a secret.

Behind a cryptocurrency, a team that runs the blockchain’s project, validating and storing the complete history of transactions on the network. Such groups are called nodes. Their work involves, among other things, generating new blocks in the chain of blocks from which the cryptocurrency is built. In simple words, it’s called mining.

Cryptocurrencies are dynamically evolving projects; in some cases, projects require significant changes. However, this is often easier said than done. For example, one miner may propose that another miner perceives it as very radical compared to the previous version of the cryptocurrency. In the worst case, they don’t agree on how to do it, leading to a split or fork of the cryptocurrency.

Crypto Fork Explained

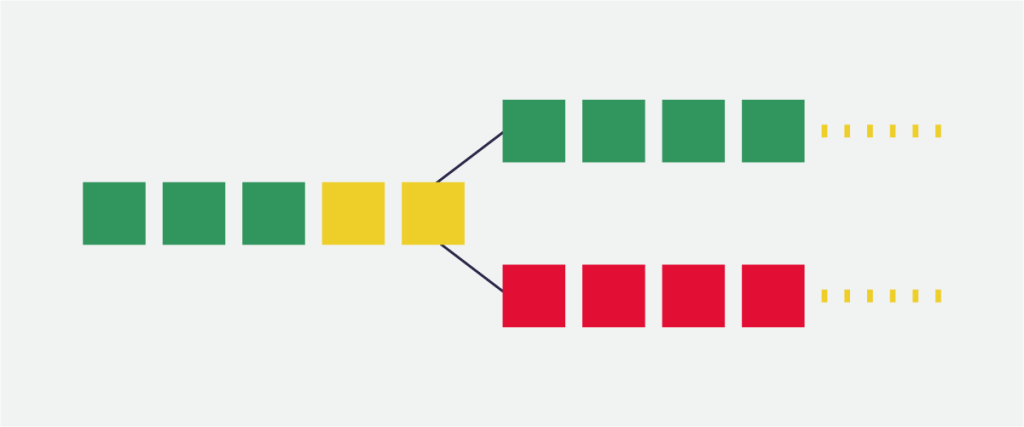

So, what is a crypto fork? It is an evolutionary creation of a branch on the blockchain. It results in a creation of a network that is parallel to a pre-existing. All crypto forks are divided into two types: crypto hard fork and soft fork. Let’s understand how they differ.

What is Hard Fork in Crypto?

What is hard fork in crypto projects? It is splitting a blockchain into two different entities, starting with a specific block. The rules of the new blockchain may be conceptually distinct from the existing blockchain, and all new blocks are not compatible with the old ones. It is one way of creating new cryptocurrencies.

When a hard crypto fork occurs, miners must choose to stay on the existing blockchain or start mining blocks for the newly created one.

Soft Crypto Fork

Unlike the definition of ‘hard fork crypto’, soft fork is a meaningful update to the network that introduces new rules but does not break the original logic of the blockchain or create new entities. A classic example of a soft fork is changing the size of a blockchain, say from 1024kb to 512kb. Also, this crypto fork often occurs when a whole bunch of new functionality is implemented into the blockchain at programming level. It’s as if the coin remains the same, but things are no longer the same under the hood. However, blocks before and after such crypto forks maintain backward compatibility.

It is worth noting that due to misuse of the term crypto fork, it most often means a hard fork crypto.

When a Crypto Fork is Used

To better explain crypto fork meaning, let’s look at the reasons that may lead to a fork in crypto projects.

A crypto fork is, first and foremost, a breakthrough tool. But, as we said at the very beginning, it is often used when there is too much disagreement between community members. Ultimately, the project breaks up into two separate chains, which will develop entirely independently of each other.

The second case of crypto fork application is a necessary measure after the attack. In this case, the fork is used to restore network conditions before the attack. However, some users criticize this method and believe the blockchain should never be changed.

In the case of Terra, the issue of the fork was raised around this second case. If the crypto fork is confirmed, the blockchain will split into two parts. One will revert to network conditions at some point (as decided by users), and the other will not. In addition, some blockchains are designed to be fork-proof in their structure and design

The Most Famous Crypto Forks

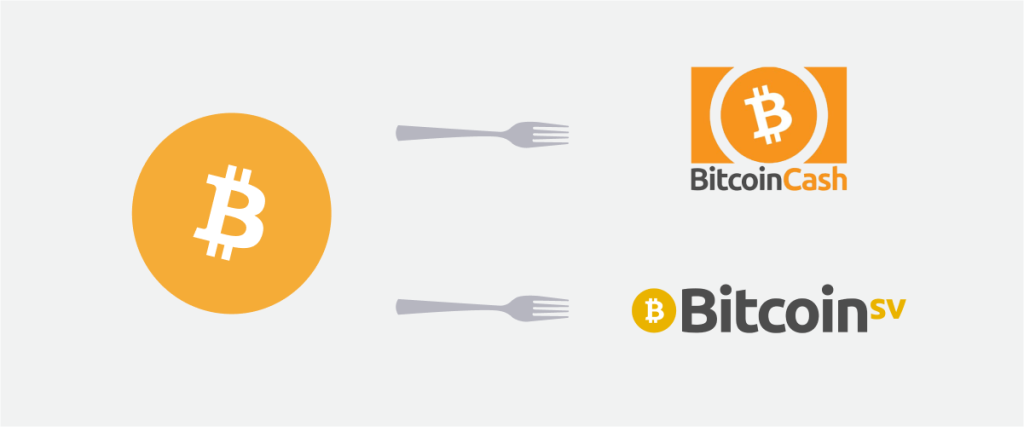

If we are looking for the most famous crypto fork, we will probably have to turn to the king of all cryptocurrencies. In August 2017, the Bitcoin blockchain confirmed a fork between Bitcoin (BTC) and Bitcoin Cash. This fork stemmed from a disagreement between community members over block sizes. A few months after this crypto fork, Bitcoin Cash will undergo a new crypto fork, resulting in the Bitcoin Cash (BCH) and Bitcoin SV (BSV) projects.

The Ethereum blockchain has also experienced a crypto fork, which is still one of the most significant. After the DAO hack, the community was divided into those who wanted a rollback and who did not want to change the blockchain. This disagreement led to the July 20, 2016 fork and the creation of Ethereum Classic (ETC) in addition to Ethereum Network (ETH).

In both of these examples, as in most cases, the original asset retains the most value. Indeed, Bitcoin (BTC) is now much more valuable than Bitcoin Cash. The same can be said for Ethereum, which is far superior to Ethereum Classic.

To Sum up

So now you know the answer to the question, ‘what is a crypto fork?’ Whether hard or soft fork, it is a milestone in the life of every blockchain. Is it good or bad for the project? It all depends on the reasons described in the article. But, as we can observe, it happens sooner or later with most cryptocurrencies based on their protocol.