Six slow killers of your crypto project

For the last five years of working with crypto startups and businesses that make the first steps in the crypto industry, we’ve been through many situations with our clients. Launching more than 1000 projects successfully, we can’t say for sure how many crypto startups failed… But we can tell you why that’s happened, so you can check if your project doesn’t have those symptoms.

This list of typical mistakes we collected with Andrea Frolova, the Head of Customer Success for P2B, and the whole listing team. What is hidden behind the “mistakes” in the eyes of our experts: inefficient activities, wrong assumptions and hopes, misconceptions, and the design of the crypto project organization. What is a failure, you can guess: money wasted, the team is disappointed, nobody knows about your token, and nobody needs it.

We want you to prevent all these unpleasant occurrences in your project. Read this article to self-analyze and find the way out of this trouble. If you have another problem that slows down your crypto business, contact Andrea and the team to find the solution.

Typical mistakes of a crypto project leading to disaster

The strategy is for traditional business, not for crypto

There’s a myth or common misconception about the crypto industry and other blockchain-related businesses that everything there should be super-fast. You don’t have time to think, plan, or design. You must run faster than the train of the whole market to be at least not squished by the losers. But that’s not true. Before you enter the market, you have to:

- Investigate the market: we can get you through these jungles and explain their mechanics;

- Become fluent with your instruments: work with our exchange to find out what will be on each stage of promotion on our exchange and how to fortify your positions in the market using us as a tool;

- Know who you are looking for: find your perfect investors and build relationships with them. Invent your tokenomics—the mechanics of profit for your project based on crypto assets. And then, prepare a plan for how to scale your idea.

How do you like it? It doesn’t look like a quick start, right? The sour truth sounds like that: the longer you want to appear in the market, the more thoughtful your preparation should be.

Poisoned Positioning: “My token is for everybody!”

We hear that in 25% of all projects that come to us. The assurance that your project is a holy grail that will be more important than bread for all people in the world only shows us that you never thought about that deeply.

The truth is that nobody needs another coin. The token itself is an instrument for people to solve their problems or to indulge their feelings. If your targeting and positioning sound like for anyone from 18 to 99+, you’ll fail. Of course, some miracles might appear, and you’ll find your audience accidentally, but with messy messages “for everybody,” you can miss them quickly…

So be ready to forge your positioning and targeting on your audience. You have options to make it hand in hand with P2B managers or alone with your team. In both cases, be sure your practice is supported by data and practical experiments, not theoretical assumptions. The less you try to guess, the fewer risks you’ll take.

Misunderstanding of how the crypto exchange works

We’ve mentioned this briefly, but this mistake is worth a separate point. Many projects start their path in crypto without any technical or financial background regarding how the exchange works. They’ve heard of Binance and think that all crypto exchanges work the same. People come there and buy tokens, what else is your exchange for? But think over the following questions, maybe your potential investors can farm tokens on exchanges? Can they store the assets they buy there? What are smart contracts, and how do they work? Do you have a comprehensive understanding of how things and all that crypto magic happens on exchanges?

If you don’t know the answers, our team provides you with educational consulting services. P2B exchange is an open book of crypto knowledge, and we’ll be happy to clarify how you can use our platform to profit and succeed.

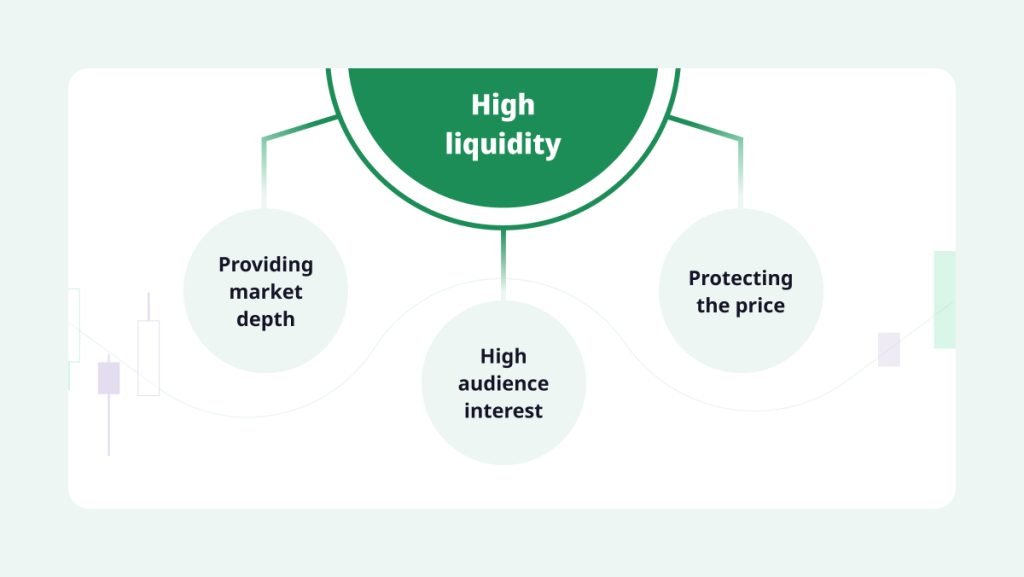

The deadly error that results from the previous point: Low-prioritized liquidity

Up to 85% of crypto newcomers don’t know why liquidity is essential for recently launched projects. Without it, your project has all chance to pass away unnoticed at any exchange. High liquidity means that in the complex estimation of different indicators, your token seems reliable and safe to trade. And that’s the exact characteristic you need! To keep your token liquid from the first days of launch, be sure to add these must-have services to your pre-launch plan:

- Providing market depth: creating enough pending orders to buy and sell your token.

- Protecting the price from the pump and dump unless it’s affected by big orders.

- Keeping the audience’s interest high by controlling the price’s spread.

“If we launch, we’ve already succeeded”

No, that’s wrong. Being listed for the first time is not a ticket to a happy future. It’s only the beginning of market conquering. If the project concentrates only on the first listing or fundraising activities, it’ll have zero resources for further development. Also, the risky strategy of “we’ll get tons of money from fundraising and will use them to promote further” brokes as glass from the question—“What if you won’t get enough money?”

Our business development experts ask many questions regarding what you’re going to do after the listing to see if you need any consultation and support with further planning. If you plan to make your token not a guest but a resident of the crypto market, the launch is only an appetizer. Be sure to plan your resources and actions further.

Rocket-speed launch and turtles afterward

Another thing to consider is the tempo of your activities. Do you know a saying that making something quickly is the same as making it slowly, but without pauses? Something like this works here in the crypto market. You have to be present for your audience all the time: in terms of trades and communications.

The mistake is being too good at the beginning and extremely lazy later. You can concentrate on too many activities with your audience first, pitch your ideas to investors, and be active on social media, etc., but after the launch or receiving minimal results, you can just run off motivation or ideas. Distribute your efforts for a more extended period of time and investigate the habits of the crypto community to be sure that you’ll make the product that will be digested by your audience today, tomorrow, and even in a year.

“Community will build up themselves”

This problem appears in the latest stages of the crypto startup development on our exchange when everything is seemingly alright, the trade is on, and our community accepts the new token with warmth. But concentrating only on one part of the global community is a dead-end decision. After you dig out every investor in our pool, you should ask yourself, where should we go next? And your direction should be based on the facts you get from your target audience. For example, what are other exchanges where they trade? Maybe you should list your token somewhere else. What other communication channels does your audience like? There might be a Twitch channel with a coin nerd that should talk about you to reach other communities outside our exchange.

We’ll show you how to find and test such hypotheses of expansion. But you should never stop communicating with your audience to get insights for future strategies.

Two amusing kinds of crypto startup leaders: Is this about you?

So here you have it. Our shortlist of deadly sins of crypto startups is over. One misconception always results in another, and even a tiny snowball can cause an avalanche to bury your crypto initiatives.

So analyze your own attitude: are you enthusiasts that won’t even believe that 92% of all crypto startups will die and won’t become stable businesses? Or are you just for hype here, to get first investments and leave the exchange during the fireworks show? Both categories should change their mindset and decision-making to become constantly profitable in crypto. The way you do that is always deeply personal…

P2B knows how to point you in the right direction. Let’s have a talk!