Coin Listing: Dos & Don’ts

Effective listing of your coin or token on a crypto exchange is a sophisticated process that might be too much to handle if you lack experience. Still, nothing’s too challenging if you pick a solid exchange and get a little bit of helpful advice. For a solid exchange, check our listing page to see the benefits your token is going to get. As for helpful advice, well, just read on. Keeping in mind these dos and don’ts, it will be easier to get things right from the start.

Dos

1. Prepare a good technical foundation

If your project is still under development, or even if it is mostly ready with just a few issues left to solve, you may hit the wall of rejection. Any solid exchange you apply to will conduct a thorough analysis of your project. However, you can always learn more about their particular requirements for tokens beforehand and prepare well. You might even find out some problems you have never thought of — and find a way to solve them and improve your token.

2. Always do your own due diligence

In other words, learn as much as possible about the exchange you want to list on. Study their agreement and pricing. Check their overall stats and the fullness of their service packages. Consider every single requirement they have for applicants. This will help you to determine whether this exchange is suitable for your token and your budget. Needless to say, the better you understand the platform you are applying to, the higher your chances of getting listed quickly and effortlessly.

3. Keep in mind that you can always address a listing agency

You might want to save your personal time and get guaranteed results, so you can outsource search and listing to a specialized agency. They will take over the preparation, application and communication to facilitate your listing, while you will be able to shift your efforts and focus on the promotion of your token. The main thing here is to select a good agency, with extensive experience and connections with exchanges, which can enable them to get partner discounts for your listing, thus making your investment pay off more effectively.

4. Straighten out the legal side of your project in advance

The legal aspects of creating, operating and listing a cryptocurrency can turn out to be important — especially if you are aiming for a top-tier exchange. Like we said previously, you can ask for legal requirements and study them to see whether compliance can be ensured.

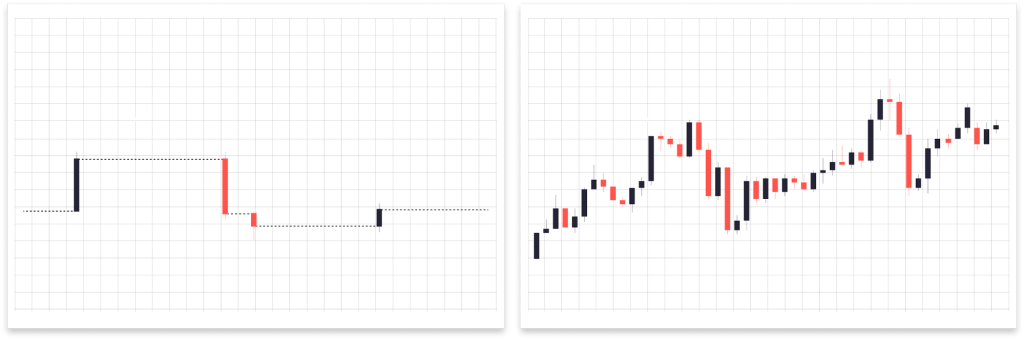

5. Use market making to help your token grow on the exchange

Market making services aim for creating a healthy environment for your token at the earliest stages after listing. The result is steadily growing trade volume, well-filled order book, low spread and high liquidity — everything that makes your token attractive for traders and potential investors.

Candlestick chart before and after market making

Note: Market making services are typically provided by specialized agencies. However, some mid- and top-tier exchanges have in-house market making departments, and these services are included in listing packages.

Don’ts

1. Don’t try to encompass many exchanges at once

If you have a fixed budget, it is better to get listed on a couple of respectable mid-tier exchanges and provide your token with proper market making, than to spend the same budget on 5-10 small and ineffective exchanges with low volumes and liquidity. What’s more, listing on an untrustworthy exchange may as well damage the reputation of your project, which is the worst possible scenario.

2. Don’t try to get listed on the mastodons of the industry right away

Well, unless your project is big enough to afford it, of course. However, in most cases listing on a top exchange with billions-worthy turnover is expected to eat the entire budget, if not exceed it. Moreover, something this large and significant is always in the public eye, closely monitored by the government. That means that the exchange makes it obligatory for all partners to be as transparent and legally solid as possible. Lastly, the chance of success is not always as high as the amount of spent money and effort. Is it really worth the risk? Returning to the previous point, it might be better to get listed on a solid mid-level exchange.

3. When it comes to looking for assistance, don’t trust populist ads

Any outsourcing company that provides listing services might try to lure you in by any means, promising more than can actually be done. Moreover, there are scams abound in the crypto world, and you need to avoid them by thorough examination of the exchange you are going to apply to. Check their stats, rankings on top crypto resources, projects in the portfolio, approval rates, feedback on independent platforms. If the exchange guarantees certain results, ask for detailed reasoning.

4. Don’t hurry to get answers

Once you have filed an application to a cryptocurrency exchange, the best thing you can do is patiently wait for the answer. It is no use flooding around with reminder emails. Every reputed exchange has clockwork support service that receives and processes all inquiries and applications. Communication should be laconic and efficient.

5. Don’t forget to market your project and grow your community

Generating regular buzz around your project is essential for survival in the crypto world. Tokens come and tokens go, and it is hard to maintain public interest in your project and keep boosting trade volumes on the exchange. Don’t forget that people who invest in your token are what keeps your project afloat. If you lose their interest, you may just go under. However, with a proper approach, it is not as difficult as it may seem. Make at least 1 big post a week, and ideally 2 short news a day. Ads and guest posts can also make up a piece of the pie. Stimulate the interest of your investors, deliver valuable information, provide updates to show that the project is not stagnant, but alive and well and actively developing.